For State Bank of India (SBI), a reverse interest rate cycle could bring several impacts:

1. Net Interest Margin (NIM):

SBI’s Net Interest Margin, which is the difference between interest earned and interest expended, might be affected. If borrowing costs rise faster than lending rates, it could compress the NIM, impacting profitability.

2. Loan Portfolio:

SBI’s loan portfolio, including mortgages, personal loans, and corporate loans, could see changes. Higher interest rates might reduce demand for loans, impacting the bank’s lending business and potential revenue.

3. Asset Quality:

Rising interest rates might impact borrowers’ ability to repay loans. SBI may need to closely monitor its asset quality to prevent a potential increase in non-performing assets (NPAs) due to borrowers struggling with higher borrowing costs.

4. Deposits and CASA (Current Account Savings Account):

As interest rates rise, SBI may witness an increase in the cost of deposits, especially in fixed deposits. Managing its CASA ratio becomes crucial as these accounts have lower interest payouts, helping control the cost of funds.

5. Investment Portfolio:

SBI’s investment portfolio, especially in fixed-income securities like bonds, might see changes in valuation due to changing interest rates. This could impact the overall investment income.

6. Impact on Profitability:

Fluctuating interest rates could impact SBI’s overall profitability. If the bank can effectively manage its assets and liabilities during the rate hike, it might mitigate some negative impacts on profitability.

7. Market Sentiment:

Stock prices of banks, including SBI, might experience volatility as investors reassess their portfolios in response to changing interest rates and their anticipated impact on the banking sector.

In conclusion, a reverse interest rate cycle could pose challenges for SBI, impacting its NIM, loan demand, asset quality, and overall profitability. However, the extent of these impacts would depend on the bank’s ability to manage its loan portfolio, control costs, maintain asset quality, and adapt its strategies to changing market conditions.

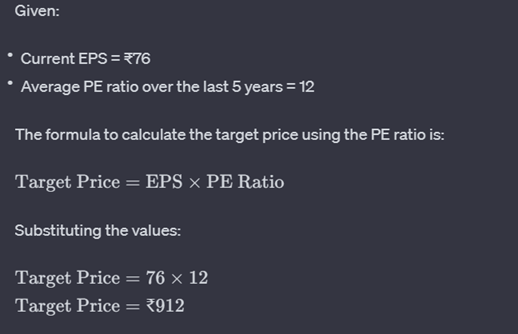

Providing the current earnings per share (EPS) of 76. Now, let’s recalculate the target price using the updated EPS and the average PE ratio of 12 over the last 5 years.

So, based on the current EPS of ₹76 and an average PE ratio of 12 over the last 5 years, the estimated target price for the company would be ₹912. This suggests that if the company were to achieve a PE ratio of 12 based on its current earnings, the target price could potentially be ₹912.

Technical Target is 723

I will right away take hold of your rss feed as I

can’t find your email subscription hyperlink or newsletter service.

Do you have any? Please allow me realize so that I could subscribe.

Thanks.